Quantum Computing Stocks Soar: Rigetti & Market Surge ExplainedHey guys, have you been keeping an eye on the market lately? Because if you have, you’ve probably noticed something

super exciting

happening in the tech world:

quantum computing stocks

are absolutely taking off! We’re talking about companies like

Rigetti Computing (RGTI)

, which has been making some serious waves. It’s not just Rigetti, though; the entire quantum computing sector seems to be experiencing a significant surge, driven by promising technological advancements, strategic partnerships, and a growing buzz around its transformative potential. This isn’t just a flash in the pan; it feels like we’re on the cusp of something truly revolutionary. The interest from both individual investors and institutional giants is palpable, making this a

hot topic

everyone’s talking about. You might be wondering, “What exactly is going on?” Well, buckle up, because we’re diving deep into the reasons behind this remarkable surge, exploring the key players, understanding the underlying technology, and figuring out what this all means for the future of tech and your investment portfolio. We’ll break down the complex world of quantum mechanics into understandable, actionable insights, making sure you’re well-equipped to understand this fascinating market phenomenon. From groundbreaking research to commercial applications, the landscape of

quantum computing

is evolving rapidly, and its impact on various industries, from pharmaceuticals to financial services, is becoming increasingly clear. This surge isn’t just about speculation; it’s about the tangible progress these companies are making toward solving some of the world’s most

complex problems

that even our most powerful supercomputers struggle with today. The recent positive market news surrounding these innovators is providing the fuel for this impressive performance, especially for those

quantum computing stocks

. So let’s get into it and explore why everyone’s suddenly so bullish on quantum, specifically noting the renewed investor confidence reflected in companies like Rigetti’s recent market movements.## Understanding the Quantum Computing Hype: What’s the Big Deal?So, what

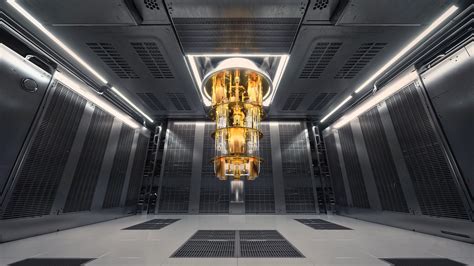

is

quantum computing

, and why is there such a massive hype around it right now? Simply put, guys,

quantum computing

represents a fundamentally different approach to computation compared to the traditional computers we use every day. Instead of relying on bits that are either 0 or 1, quantum computers use “qubits” which can be both 0 and 1 simultaneously through a phenomenon called

superposition

. This, along with other mind-bending quantum mechanics like

entanglement

, allows them to process vast amounts of information and solve certain problems exponentially faster than classical computers. Imagine trying to find a needle in a haystack; a classical computer checks each piece of hay one by one, but a quantum computer, in a simplified sense, could examine many pieces at once.

That’s the power we’re talking about.

The big deal really boils down to its

potential

to revolutionize countless industries. Think about drug discovery, where new molecules could be simulated with unprecedented accuracy, drastically cutting down research times. Or consider financial modeling, where complex algorithms could optimize portfolios and predict market trends with greater precision. Even in artificial intelligence, quantum algorithms could supercharge machine learning, leading to truly transformative AI systems. However, it’s also important to remember that this technology is still in its

early stages of development

. We’re not talking about quantum computers replacing your laptop tomorrow. They are highly specialized machines, often requiring extremely cold temperatures and shielded environments, and they are incredibly difficult to build and maintain. But the progress,

oh the progress

, is undeniable. Major tech giants and innovative startups are pouring billions into research and development, constantly pushing the boundaries of what’s possible. This sustained investment and the incremental breakthroughs are what fuel the current excitement and, consequently, the surge in

quantum computing stocks

. It’s a long game, but the potential payoff is

enormous

, making it a compelling area for those looking to invest in the future of cutting-edge technology.## Key Players in the Quantum Computing Stock Market: Focus on RigettiWhen we talk about the

quantum computing stock market

and its recent surge, several key players immediately come to mind, but one company that often captures headlines is

Rigetti Computing (RGTI)

.

Rigetti

has been a pioneer in developing quantum integrated circuits and quantum computers. They offer their quantum computing systems through the cloud, making their powerful machines accessible to researchers and developers worldwide. Their approach involves building superconducting quantum processors, and they’ve been consistently pushing the boundaries of qubit count and performance. What makes

Rigetti

particularly interesting right now is its recent market activity, which reflects the broader investor confidence in the sector. But they are far from alone, guys. Other prominent players include

IonQ (IONQ)

, which focuses on trapped-ion quantum computers and has also seen significant investor interest, boasting impressive partnerships and a clear roadmap for increasing qubit counts. Then there’s

D-Wave Systems (QBTS)

, known for its quantum annealing technology, primarily aimed at optimization problems, which is carving out its own niche in the quantum space. Beyond these pure-play quantum companies, tech giants like

IBM

and

Google

are also massive forces, pouring immense resources into their own quantum computing initiatives. IBM, for instance, has a comprehensive quantum roadmap and offers its quantum systems through the IBM Quantum Experience, while Google is making strides with its own superconducting processors, famously claiming “quantum supremacy” a few years back. These larger companies bring significant R&D budgets and established customer bases, validating the long-term potential of the technology. The competitive landscape is

intense

, but this competition is also accelerating innovation, which is a fantastic sign for the future of

quantum computing

. For investors, understanding the different technologies and strategies of these key players is crucial.

Rigetti’s

recent movements, alongside its peers, truly highlight the dynamic nature of this evolving market, providing valuable context for understanding the broader enthusiasm for

quantum computing stocks

. It’s an exciting time to watch these innovators battle it out to bring quantum solutions to the world.## What’s Driving the Surge in Quantum Computing Stocks? Unpacking the CatalystsSo, what exactly is fueling this

exhilarating surge

in

quantum computing stocks

? It’s not just one thing, guys; it’s a perfect storm of several powerful catalysts converging to create this exciting market momentum. Firstly, and perhaps most importantly, we’re seeing

tangible technological breakthroughs

. Companies are consistently announcing higher qubit counts, improved error correction rates, and more stable quantum systems. These aren’t just incremental improvements; they represent significant steps toward building commercially viable quantum computers. Each time a company like

Rigetti

or

IonQ

reports a milestone, it sends a ripple of optimism through the investment community, validating the immense R&D efforts. Secondly, there’s been a substantial increase in

investment and funding

from both private and public sectors. Governments worldwide recognize the strategic importance of quantum technology for national security, economic competitiveness, and scientific leadership. This translates into grants, research programs, and initiatives that accelerate development. Simultaneously, venture capitalists and institutional investors are increasingly willing to allocate significant capital to promising quantum startups, understanding the

long-term potential

for exponential returns. Thirdly,

strategic partnerships and collaborations

are becoming more frequent. Quantum computing companies are teaming up with enterprises in various industries – from aerospace to finance – to explore real-world applications and test their technologies. These partnerships validate the commercial applicability of quantum solutions and provide a clearer path to monetization, which investors absolutely love to see. And finally,

positive news cycles

play a massive role. Whether it’s a breakthrough reported in a scientific journal, a successful trial application announced by a company, or even influential tech analysts highlighting the sector’s growth, these news items act as catalysts, drawing more attention and capital to

quantum computing stocks

. The cumulative effect of these drivers creates a powerful narrative of progress and opportunity, driving share prices upward. It’s a compelling narrative of innovation meeting market readiness, and that’s why we’re seeing such impressive performances across the board, making it an opportune time to understand the dynamics behind the surge in

quantum computing stocks

.## Investing in Quantum Computing: Navigating Opportunities and RisksAlright, guys, now that we’ve covered the hype and the key players, let’s get down to the brass tacks: what does

investing in quantum computing

actually look like? This sector presents some truly

exciting opportunities

, but it’s also crucial to understand the inherent

risks

involved. On the opportunity side, the sheer transformative potential of

quantum computing

is unparalleled. If these companies deliver on their promise, the returns could be astronomical, disrupting entire industries and creating new ones. Early investors in groundbreaking technologies often reap the biggest rewards, and many believe quantum computing is

the next big wave

after AI. The addressable market is enormous, spanning everything from drug discovery and materials science to cryptography and logistics optimization. Companies that successfully develop and commercialize quantum solutions will likely command premium valuations, bolstering the appeal of

quantum computing stocks

. However, let’s not sugarcoat it; the risks are significant. This is a

highly speculative

sector. Firstly,

quantum technology

is still very much in its infancy. There are immense technical hurdles to overcome, such as achieving stable qubits with long coherence times and developing robust error correction mechanisms. The “quantum winter” (a period of reduced investment due to slow progress) is always a theoretical possibility, though current momentum suggests otherwise. Secondly, the path to profitability for many of these pure-play quantum companies is

long and uncertain

. They are heavily reliant on R&D, which is expensive and doesn’t always guarantee commercial success. Thirdly, competition is fierce, not just among startups but also with tech giants like IBM and Google, who have deep pockets and extensive research capabilities. Market volatility is also a given; these stocks can be quite sensitive to news, technological announcements, and overall market sentiment. Therefore, for those considering an investment, it’s absolutely vital to conduct

thorough due diligence

, understand the specific technology and business model of each company, and ideally, have a

long-term investment horizon

. Don’t put all your eggs in one basket, and only invest what you can afford to lose. It’s a high-risk, high-reward game, but for those with a strong stomach and a belief in the future of cutting-edge tech, the rewards could be

truly remarkable

.## The Future Landscape of Quantum Computing and Its Market ImpactLooking ahead, guys, the

future landscape of quantum computing

is nothing short of breathtaking, and its potential impact on the market is absolutely massive. We’re talking about a paradigm shift that could redefine problem-solving across virtually every major industry. Imagine personalized medicine where drug development is optimized at the quantum level, creating therapies tailored precisely to an individual’s genetic makeup. Or consider the financial sector, where quantum algorithms could analyze market data with

unprecedented speed and accuracy

, leading to more sophisticated risk management and trading strategies. In logistics and supply chain management, quantum optimization could drastically reduce costs and increase efficiency by solving complex routing problems that are currently intractable for classical computers. The implications for cybersecurity are also profound; quantum computers could potentially break current encryption methods, necessitating the development of

quantum-resistant cryptography

, which is an entire industry in itself. As these capabilities mature, the demand for

quantum computing services

and hardware will only escalate, driving continued growth in the

quantum computing stock market

. We’ll likely see further consolidation as larger players acquire promising startups, and new specialized niches will emerge. The innovation cycle will accelerate, with each breakthrough paving the way for the next. However, the journey won’t be without its challenges. Scaling quantum computers, reducing error rates, and making the technology more accessible and user-friendly are ongoing hurdles. Yet, the persistent drive from researchers, engineers, and visionary entrepreneurs, coupled with significant investment, suggests these challenges will gradually be overcome. For investors, this means keeping a close eye on companies that are not only making technical progress but also demonstrating a clear strategy for commercialization and real-world application. The long-term vision for

quantum computing

is one of profound societal and economic transformation, and those who position themselves wisely today could stand to benefit immensely from this evolving technological revolution. It’s truly an exciting time to witness history in the making, especially for those tracking the performance of

quantum computing stocks

and their promising trajectory.